Financial professionals and investors have anxiously awaited the U.S. Federal Reserve announcement to raise overnight bank lending rates for many months now. Does “Fed-watching” really matter for long-term planning?

While many market participants wait for the “inevitable” rise in short-term interest rates expected when the Federal Reserve tightens its monetary policy, some investors may have missed the benefits of an increase in short-term rates already underway as a result of broader market forces at work.

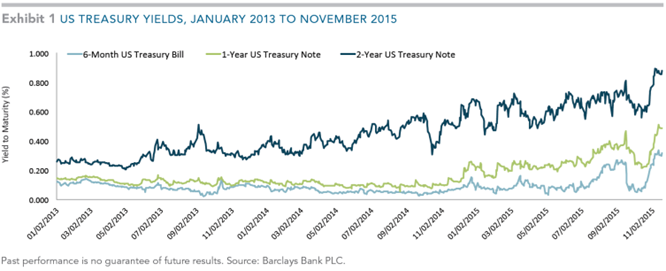

Looking at the zero- to two-year segment of the yield curve—the segment that many believe will be most affected whenever the Fed “normalizes interest rates”—it may be surprising to see how much rates have increased since 2013.

In fact, the yield on the 2-Year US Treasury note has nearly doubled since the beginning of 2015, rising from 0.45% in January to almost 0.90% by the end of November. The yield on the 1-Year US Treasury note has more than tripled, from 0.15% to more than 0.50% over the same period. The 6-Month US Treasury bill’s yield rose from a low of 0.03% in May to over 0.30% by the end of November. Yet, despite the higher rates, we have not experienced the conjectured financial storm in the fixed income market.

Chairman Janet Yellen has just announced the Fed will raise its overnight target rate this month. But we should ask ourselves a more complex question: Will the market lead the Fed or is the Fed leading the market through setting expectations?

The much maligned notion of “market efficiency” implies that market prices would anticipate such a Fed announcement weeks or months in advance. And that is precisely what Exhibit 1 illustrates.

Short-to-intermediate term U. S. government and higher quality corporate fixed income returns all show modestly positive returns year-to-date. So why does the media publicize Fed activity, with the ongoing suggestions of impending investor disaster?

One view is, bad new sells. If people preferred good news, the media would supply it. But markets don’t see news as necessarily good or bad, but progressively incorporates what is known from the past or supposed to be known in the future into security prices today.